Disclosure: The information and answers provided are estimates based on the application submitted to the Government of Alberta in October 2024 regarding the proposed regulation of massage therapists. These estimates Read More

Disclosure: The information and answers provided are estimates based on the application submitted to the Government of Alberta in October 2024 regarding the proposed regulation of massage therapists. These estimates Read More

excited to announce that the Alberta Working Group for the Regulation of Massage Therapy of Alberta has submitted the application Formal Submission Toward the Regulation of Massage Therapy under the Health Professions Act to the Minister on October 15, 2024.. Read More

CRMTA answers frequently asked questions about Massage Therapy Regulation in Alberta. Read More

CRMTA is proud to offer our members these fabulous perks from our partners at noterro! Save 25% on base clinic fees with noterro! *Members will be required to submit a Read More

CRMTA will hold its Annual General Meeting on Thursday, December 22, 2023. Read More

CRMTA will be limiting its operation hours during the December 2022 and January 2023 holiday season. Read More

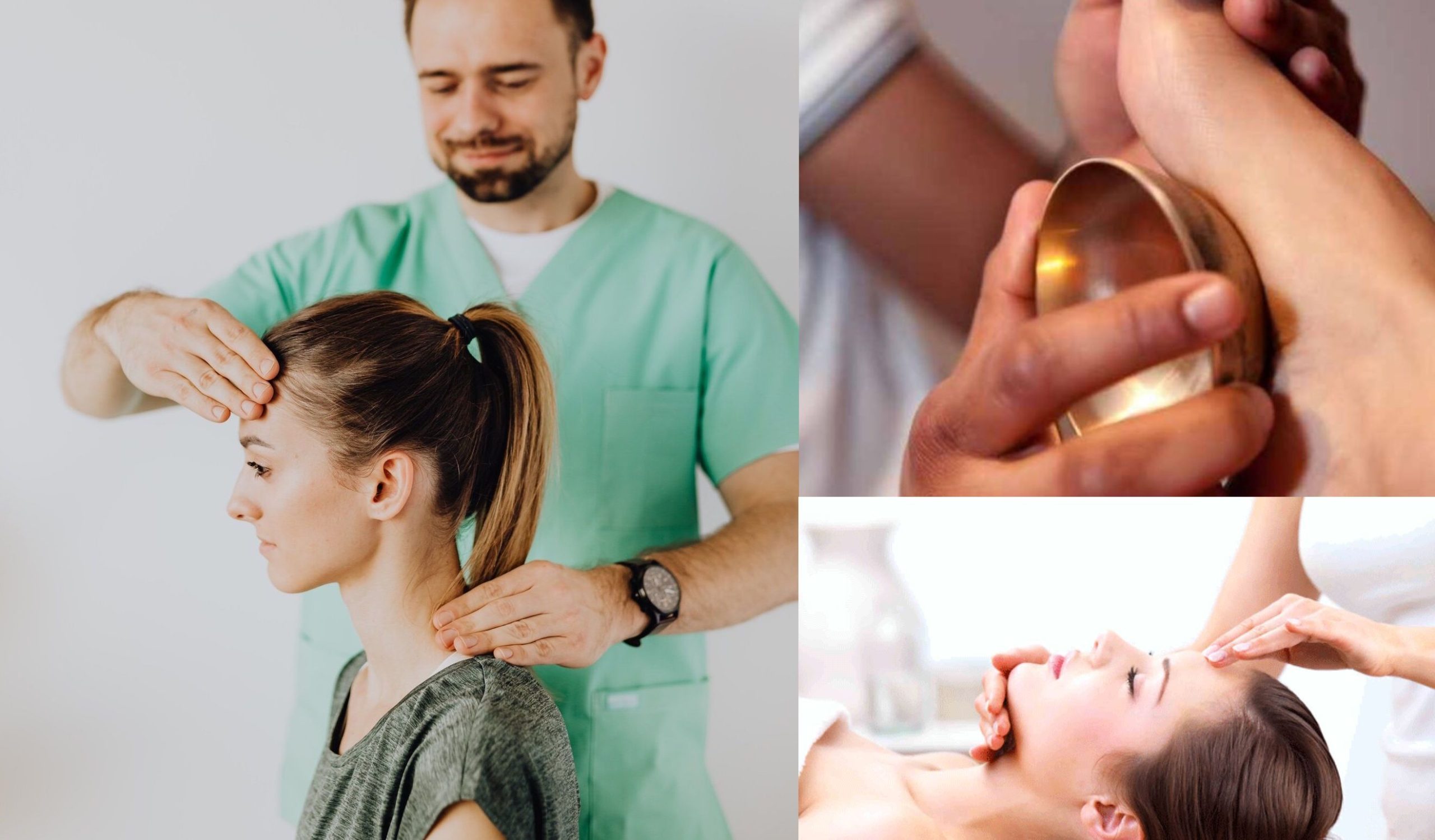

The Canadian Training Centre for Healing Alternatives is offering Indian Head Massage, Indian Foot Massage and Natural Therapeutic Face Lift Massage courses. Read More

The Transitional Council for the College of Massage Therapists of Alberta is pleased to provide an update regarding its goal of regulating the massage therapy industry in Alberta. Read More

CRMTA members are invited to attend Prenatal Massage Foundations, a two-day immersive course for massage therapists interested in treating prenatal patients. Read More

A Calgary Chiropractor is seeking two registered massage therapists (RMTs) to share office space in Bowness, Calgary. Read More